Posted: October 21, 2025 | by: Thomas F. McKeon, CFA

It was three years ago this month that the Covid pandemic exploded across the US and the globe and capital markets were in freefall.

It was three years ago this month that the Covid pandemic exploded across the US and the globe and capital markets were in freefall. This investment professional has lived through the Black Monday meltdown of 1987, the tech bubble bursting of the early 2000s, the mortgage market collapse of the late 2000s and of course the early months of 2020.

It was undoubtedly the most nerve rattling market selloff ever. One prominent financial journalist we follow wrote: “I have been a long term investor for more than 30 years. That market broke me in just 30 days.” Everyone with money committed to the capital markets had their mettle tested mightily early in 2020. Not everyone was up to the moment.

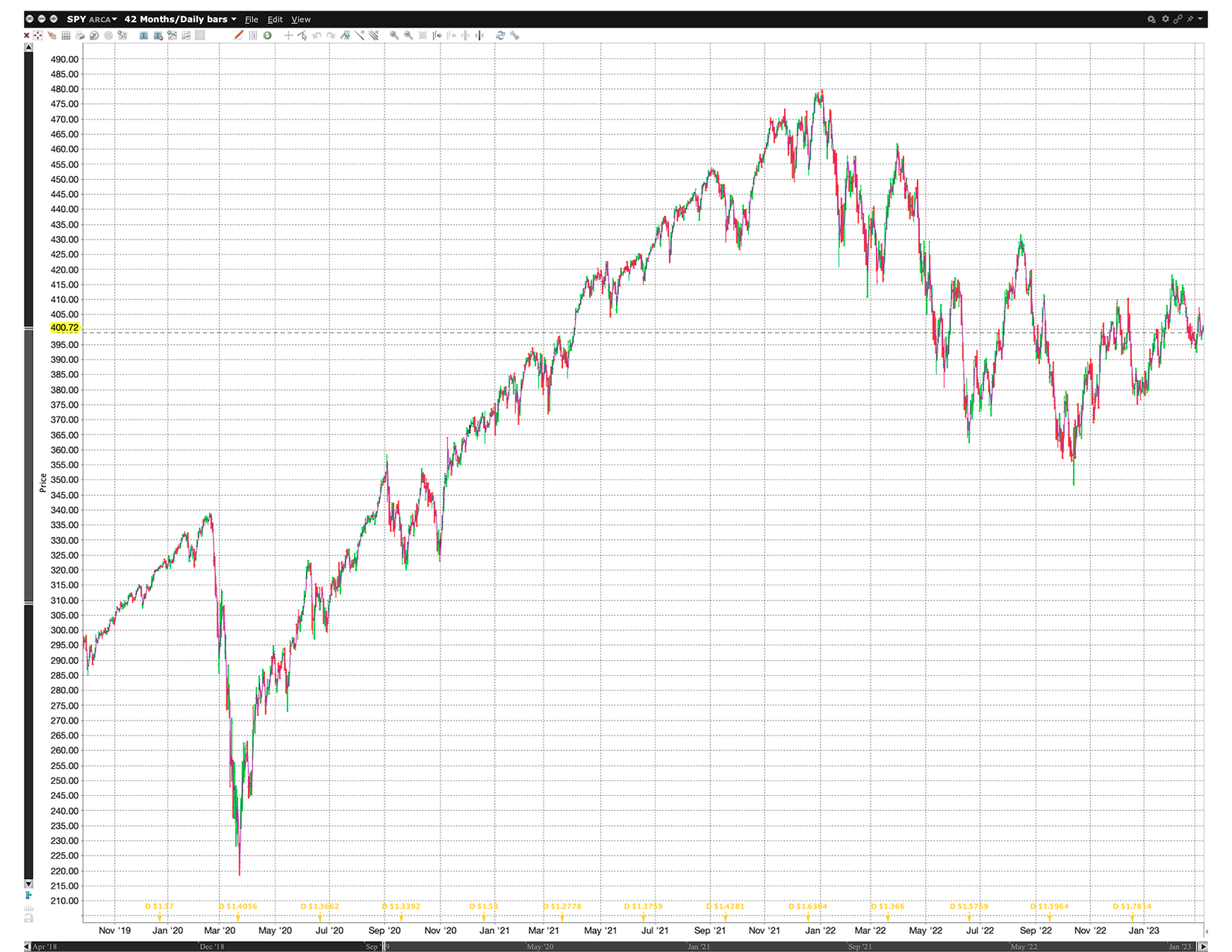

With the benefit of hindsight, it is easy to see why staying invested through that hair-raising selloff was the best course of action. Even after this recent Federal Reserve induced market selloff, the broad US equity benchmark S&P 500 is comfortably 19% ahead of the pre-pandemic peak, not including dividends through 3/7/2023. From the pandemic low on March 23, 2020, the broad S&P 500 is ahead a lush 73%, also not including dividends. Dividends would add another 2% each year for a total of 6% over this three year period. Arguably, a disciplined investor with nerves of steel would have done quite well had they been re-balancing and making purchases in March 2020.

The point is this: humans live in the moment. Without perspective and structure, we are all susceptible to the prevailing moods of the moment and it becomes easy to justify abandoning a well-structured investment program. Moreover, there are many market participants in the markets these days who foment volatility to serve their own business purposes.

Accordingly, for most investors with properly allocated and diversified portfolios, inactivity and time are your most powerful allies. It is impossible to know what the future holds. But the long-term trends in the economy and markets are solidly upward. Hitching your portfolio cart to that market horse is the best way forward.

Coming Soon...