Posted: October 21, 2025 | by: Thomas F. McKeon, CFA

From Bloomberg: Wall Street Has Surrendered to the $500 Billion ETF Rush

U.S. money managers couldn’t stop the march toward exchange-traded funds, so they decided to join it instead. Now it’s more like a stampede.

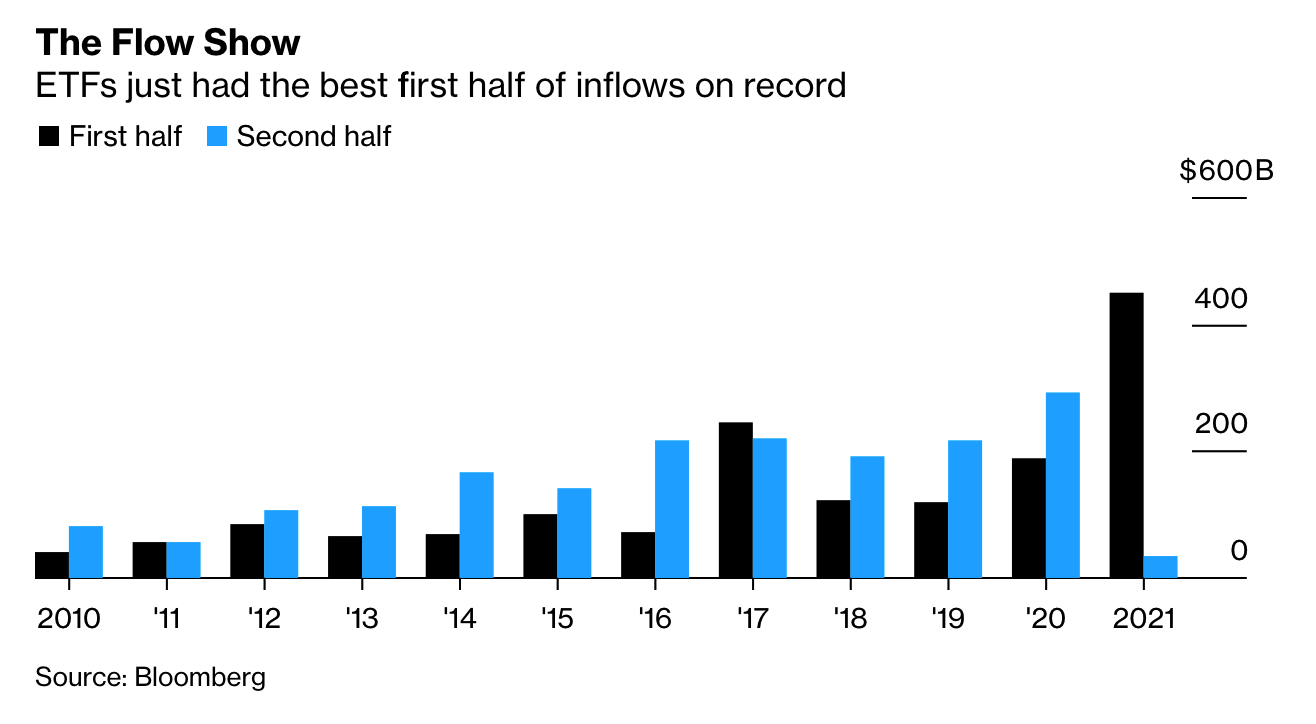

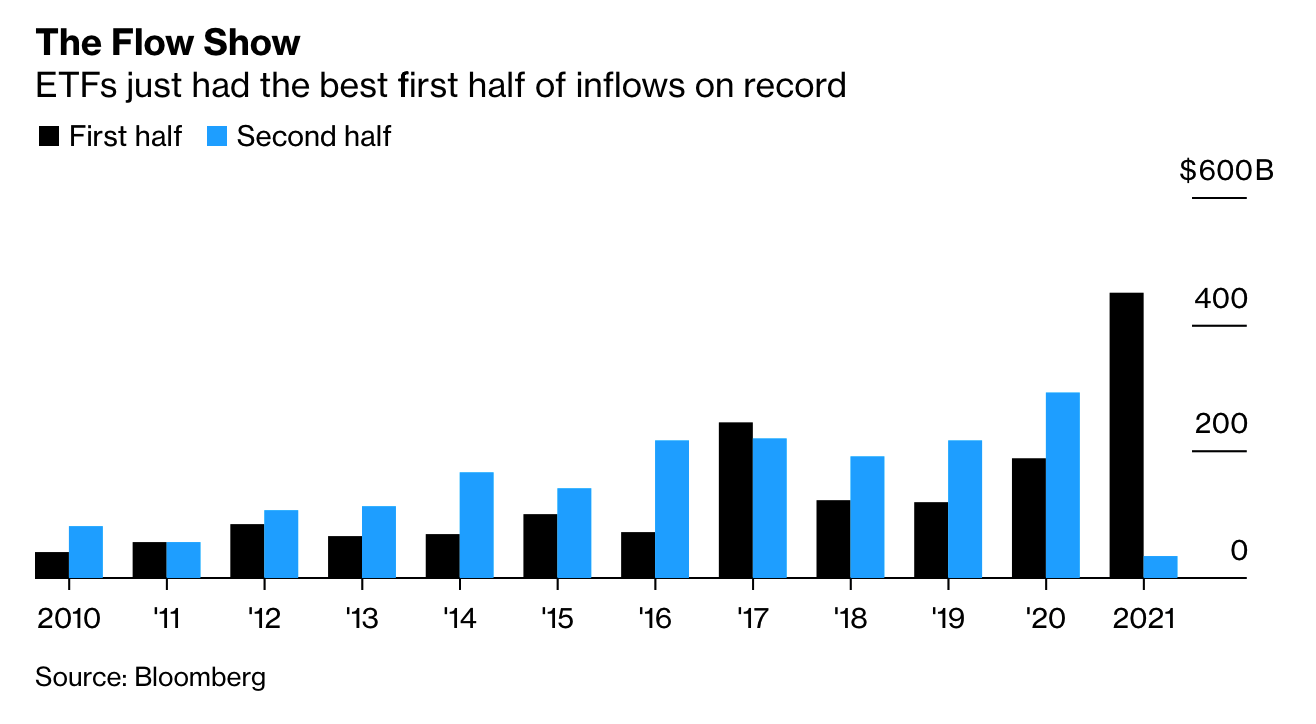

ETFs are on the brink of luring more money in seven months than in any calendar year on record. At $488.5 billion and counting, they’ll likely break the $497 billion full-year record set in 2020 in weeks, possibly days.

ETFs are vehicles that pool investor cash, just like mutual funds. The difference is they trade all day like stocks, and a quirk in the way they operate — swapping assets with an intermediary — helps them to defer tax liabilities.

First created more than 30 years ago, their popularity has surged since the 2008 financial crisis. In the brutal economic fallout, mistrust of money managers grew and investors gravitated to largely passive and transparent ETFs, doubling assets in U.S. funds to $1 trillion by 2010.

“The stress period we lived through in the first quarter of 2020 further validated not just the ETF structure but the ETF ecosystem in its entirety,” said Ben Johnson, Morningstar’s global director of ETF research. “It gave more investors greater confidence than ever that this is a suitable way to package and deliver not just different market exposures, but different investment strategies.”

"The number of active fund launches is accelerating dramatically, and with 142 debuts versus 65 for passive products this will be the first year they outnumber their index-linked rivals. Flows help explain the rush: at around 4% of the U.S. market, active ETFs are claiming about 10% of incoming cash."

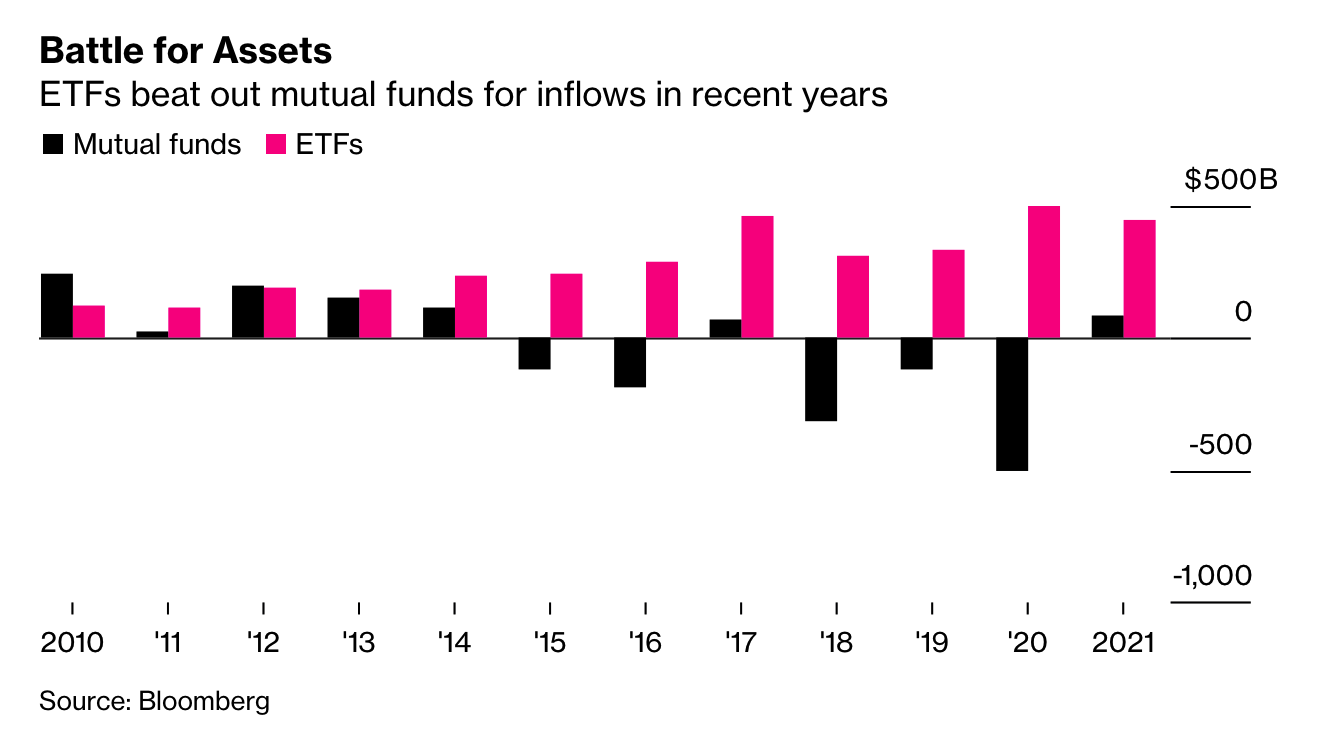

It was inevitable that the superior value proposition of passively managed, low cost ETFs would attract the attention of Wall Street competitors who think that re-packaging their expensive, actively managed strategies into ETFs would divert the flood of assets going into ETFs back into their coffers. This is of course missing the point.

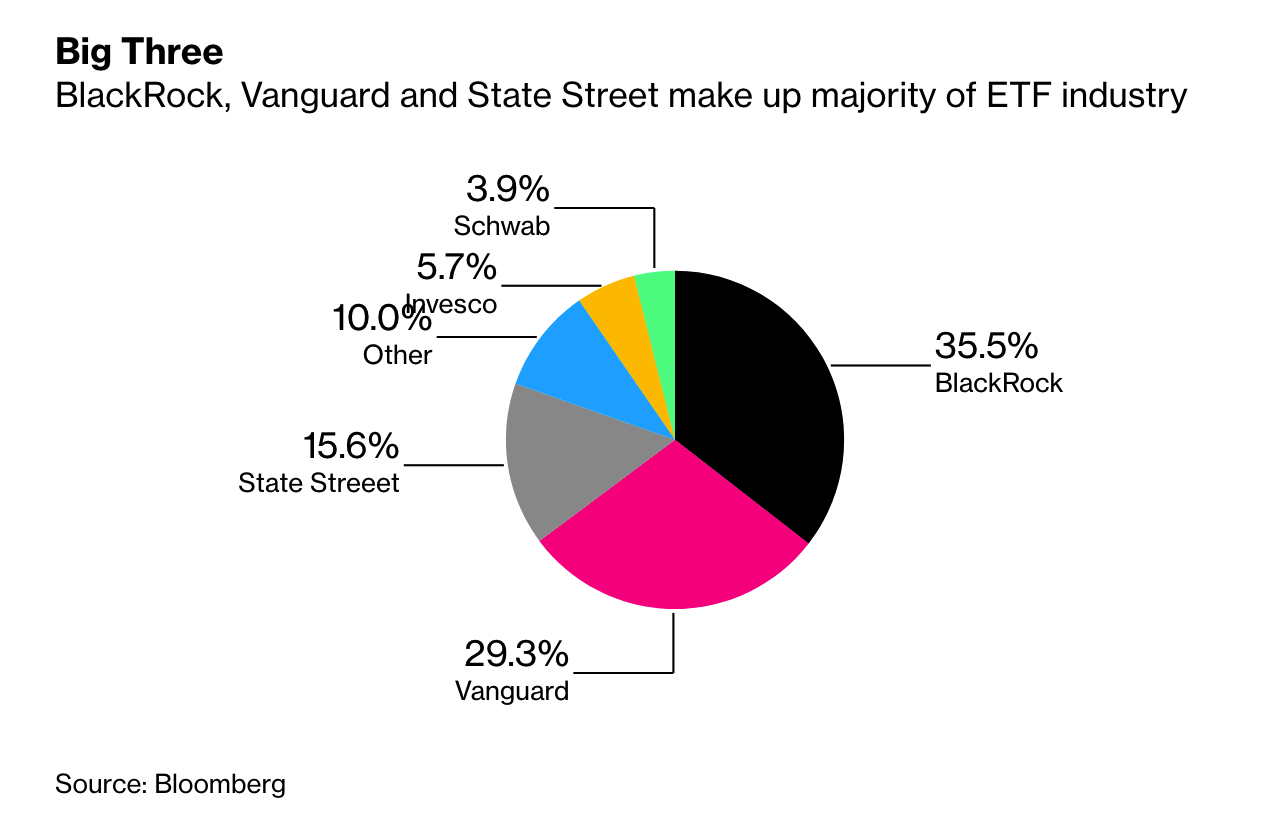

The ETF wrapper is indeed a superior way to commingle assets and package investment strategies—with the added benefits of intraday trading and liquidity (for some), and tax minimization. The main attraction of the ETFs winning all the business is however…wait for it: ultra low cost, passive strategies such as the State Street S&P 500 ETF at 9 basis points or the Vanguard Total Stock Market ETF at 3 basis points. Putting expensive actively managed strategies inside an ETF defeats the purpose. It is putting lipstick on a pig.

CSCM has used ETFs exclusively since our founding in 2010 to build client portfolios and discrete strategies…for the right reasons: pure market exposure at ultra low-cost, broad diversification, liquidity and the ability to build globally-allocated portfolios and discrete strategies for clients large and soon-to-be large.

Coming Soon...