From World Headquarters

The Kids Were Alright: A Look Back at a Portfolio From 1998

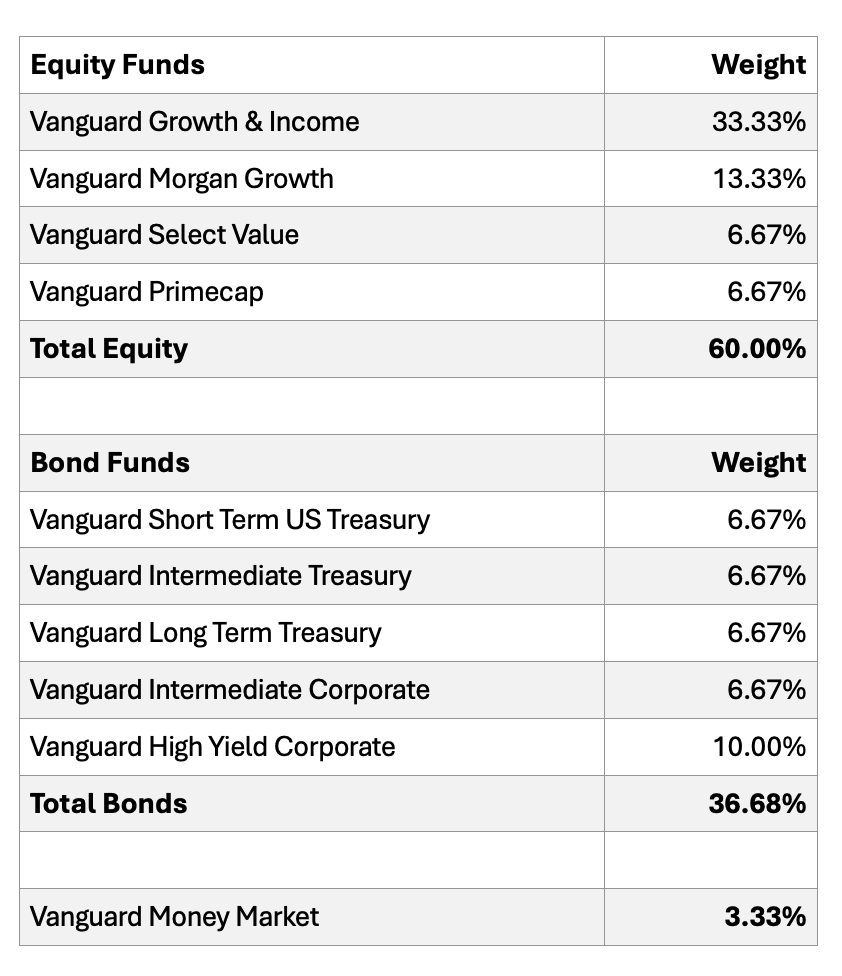

While rifling through a filing cabinet recently looking for an expired passport, I came across an amendment to my will from March 1998. It stipulated how my life insurance proceeds should be invested in the event I shuffled off this mortal coil a little prematurely. The aim was to generate returns (income and gains) that would sustain my family in the absence of my earned income, while maintaining principal. It occurred to me that looking back at investment selections made 28 years ago would be a great study in long-term returns, asset allocation, diversification, and costs. Interesting to note that almost 30 years ago my own preference for fiduciary quality investing was entirely in the direction of ultra low-cost index based market exposures. Today we manage client portfolios almost entirely with the latest and most robust iteration of low-cost, index-based market exposures and traded as Exchange Traded Funds (ETFs). Vanguard, iShares and StateStreet ETFs represent the vast majority of our portfolio investments with a few other ETFs sprinkled in for diversity and perhaps a little extra returns. You might notice that this is a proverbial 60/40 portfolio: 60% stocks and 40% bonds and cash. It was once a stock asset allocation for institutional investors: the “balanced” portfolio. Far too many of my financial service brethren are dismissive of the 60/40 portfolio, mostly because they have something more esoteric and expensive to sell. You might notice as well that the entire portfolio was invested in the U.S. markets, no global exposure whatsoever. Today, all of our portfolios include meaningful exposure to International developed and emerging market stocks, bonds and real estate. These add yet more return potential, broader allocations and more diversity. In the amendment to my will I estimated that the above mix of investments would generate an annual total return of 8.0%, of both income and capital gains. Using historic returns available on the Vanguard website I calculated that the annual total return for this portfolio was 8.79%…a comfortable extra return of 79 basis points above my estimate of 8.0%. The equity investments returned 11.19% annually, the bond investments returned 5.42% annually and the money market returned 2.50% annually over that period. For reference, the original ETF—the State Street S&P 500—benchmark returned 10.8% annually over its lifetime commencing in 1993. Our 8.79% annualized for a 60/40 balance portfolio compares quite favorably. Some of the funds used in 1998 no longer exist, have been folded into other funds or whatever. Where a Vanguard fund selected in 1998 no longer exists, I made a reasonable selection of a very close proxy to get the long term returns for that investment. This simplistic analysis assumes a straight line annual return of each of the funds, but reality is a little more volatile as we all know. Still, the near 30 year period smoothes out the market variability. The 28 year period examined here includes the last couple years of the tech market rally in the late 1990s, the tech bubble burst in the early 2000s, the market gains preceding the mortgage market debacle and ensuing Great Financial Recession, a strong sustained up-market from 2012 until the Covid Panic of early 2020, before a strong rally through the end of 2021. 2022 was a down year of almost 20% for the MSCI US Broad Market Index which has been followed by three strong up years: 2023-2025. Through it all, this purely passive portfolio gained 8.79% in annual total return. A $1 million portfolio would have provided roughly $88,000 in spendable income and gains, while a $1 million portfolio with all returns re-invested would have grown to $10.58 million over that 28 year period. This simplistic scenario takes no account of taxes or inflation which are of course real issues that impact real portfolios. But it is very instructive on the benefits of a long term approach, an index-based low-cost approach and a portfolio with less activity (in this case no activity) versus an over-active trading and re-balancing approach. Anecdotally, stories abound in this industry of some accounts at large financial institutions that were forgotten or neglected over a period of time and when re-discovered it turns out that the neglected accounts outperformed the accounts that were actively attended to and managed. There is a lesson there for us all. Thomas F. McKeon, CFAThe Portfolio:

The Returns

The Outcome and Lessons Learned

February 18, 2026