WHAT WOULD LOWER FEES AND BETTER RETURNS DO FOR YOU?

YOU OWE IT TO YOURSELF TO FIND OUT.

SCHEDULE A FREE CONSULT

We can’t improve every portfolio. But you might not be surprised to learn that far too many portfolios are poorly allocated, concentrated in the home country or hot (for now) sector, under-diversified, invested in highly speculative pseudo-assets, invested in expensive funds or products, or just paying too much in fees.

All of that combines to degrade long-term performance, endure too much risk, and generally reduce your chances for a satisfactory outcome.

SCHEDULE NOW...

CHOICES, CHOICES, CHOICES...

When looking for someone to help you achieve your investment objectives efficiently and cost-effectively, there are many vendors, investments, products, service models, professional credentials and compensation arrangements to choose from.

Let us learn a little about your assets, goals and objectives and then tell you how our services, portfolios, pricing and professionals might give you the best opportunity to achieve your investment objectives.Then you decide if it makes sense to take the next steps.

NEW RELATIONSHIP CHECKLIST

Download our NEW RELATIONSHIP CHECKLIST to see the steps we take together to establish a sound, compliant and productive investment advisory relationship.

One that helps you understand the advice and actions we will undertake on your behalf, our fiduciary responsibilities and one that will give you the best opportunity to achieve your goals and objectives over your expected time horizon.

What We Do

We help investors achieve their investment objectives with greater certainty and less risk at low cost.

We advise and manage wealth, portfolios and discrete strategies for private and institutional asset owners. Fiduciary investment advice, wealth management & planning, investment counseling and discretionary portfolio management is our only business. We answer and are accountable solely to our clients.

Prudent, optimized, fiduciary investing reduces to this simple proposition:

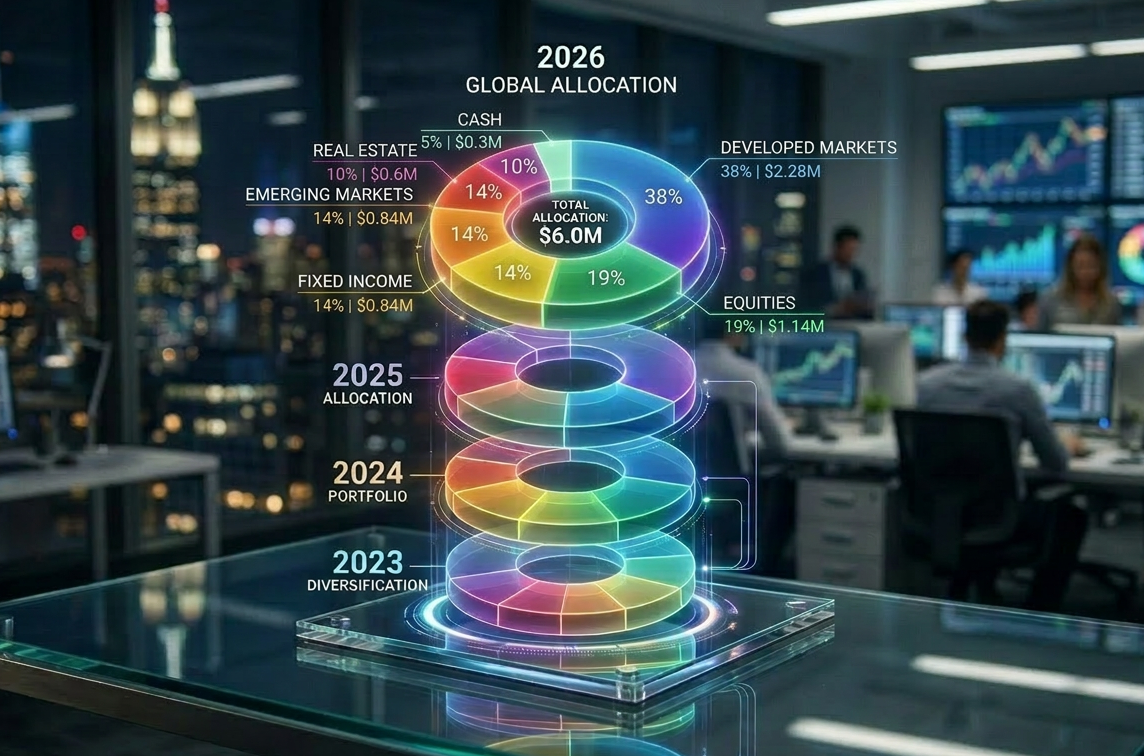

Capturing market returns as efficiently as possible. Assembling the right mix of global market exposures— exposures (stocks, bonds, real estate, cash) that can enhance returns, mitigate risk or both—in the right proportions and the appropriate liquidity for your particular return and risk profile, and accessing them through the appropriate accounts/vehicles/products as cost effectively as possible.

Any departure from that simple premise is a step towards greater cost, greater risk and greater outcome uncertainty.

Is Your Portfolio Optimized...?

Schedule a Virtual Meeting

Today is Monday, March 9th, 2026 | 12:57:00 PM

Take the first step towards improved investment outcomes and lower fees.

Schedule Here...

or email: support@clothiersprings.com

The Kids Were Alright: A Look Back at a Portfolio From 1998

Posted: February 19th, 2026

A look back at how a portfolio recommendation from March 1998 would have turned out. Hypothetically of course.

Premium Points 4Q-2025 | The Bi-Polar Market

Posted: February 6th, 2026

In this issue: From the Cio's Desk, Review and Outlook for 2026, Model Portfolio Performance, Expectations for the Economy, "The Rot in Private Equity" and 2026 Grammy "Best New Artist" Award Winner Olivia Dean sings her hit "Man I Need" and Closing Thoughts.

Peace on Earth & Happy New Year 2026

Posted: December 30th, 2025

Peace on Earth & Happy New Year 2026